AI adoption trends in Australia and New Zealand: How sales intelligence is reshaping B2B sales

Ramya

on

July 2025

AI adoption trends in Australia and New Zealand: How sales intelligence is reshaping B2B sales

- July 2025

As AI (artificial intelligence) becomes more than just a buzzword, sales teams across Australia and New Zealand are turning to smarter sales intelligence tools to work faster, sell smarter, and gain an edge. From large enterprises to nimble start-ups, AI adoption is picking up pace – but not everyone is at the same point on the curve.

So, where do you sit? Are you part of the early majority embracing AI to drive sales performance, or still waiting to see how it plays out?

We unpack current AI trends across both countries, spotlight the industries leading the way, and explain how AI-powered sales intelligence is reshaping the way businesses connect with buyers.

Understanding the AI technology adoption curve

The technology adoption curve categorises users into five groups based on how quickly they embrace new innovations:

- Innovators (2.5%) – The earliest adopters, often tech enthusiasts or researchers.

- Early adopters (13.5%) – Visionaries who see AI’s potential and implement it ahead of competitors.

- Early majority (34%) – More pragmatic businesses that adopt AI once it proves its value.

- Late majority (34%) – Cautious adopters who wait until AI is standardised and widely accepted.

- Laggards (16%) – Businesses or individuals who resist AI adoption until it’s unavoidable.

Right now, AI adoption in the ANZ region is shifting from early adopters to early majority – especially when it comes to revenue teams using sales intelligence to fuel better prospecting and outreach.

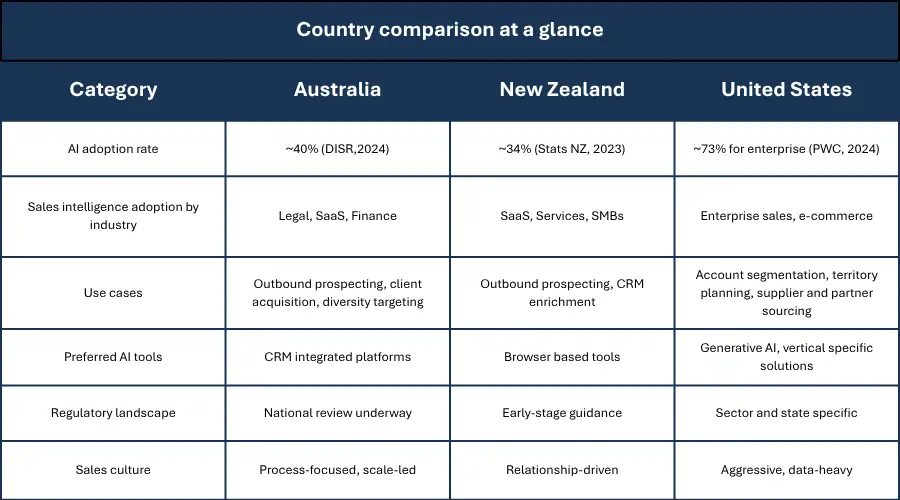

Australia, New Zealand, and the USA: How AI adoption compares

AI is reshaping sales motions across markets, but each country has a distinct adoption profile. Let’s break it down.

Australia: Enterprise-led innovation

Australia has seen strong AI uptake, particularly among large businesses and publicly listed companies. The Artificial Intelligence Action Plan and Emerging Technologies report highlight growing investment.

Key traits:

- Enterprise AI projects and CRM-integrated tools

- Fast adoption in SaaS, finance, legal, and public services

New Zealand: Nimble and outcome-driven

New Zealand businesses take a pragmatic approach to AI. Stats NZ reports that 34% of medium-to-large businesses are using or testing AI.

Key traits:

- Strong uptake in tech, SaaS, and small services firms

- Adoption driven by ease-of-use and speed to ROI

- Cloud-based sales tools with lower barriers to entry

United States: Global leader, fragmented by size

The US leads global AI innovation, but adoption differs dramatically by business size. According to PwC’s AI Business Survey, over 73% of large US companies have embedded AI in at least one business unit.

Key traits:

- Leading in generative AI, sales automation, and MarTech

- Start-ups and SMBs follow trends set by enterprise giants

- Regulatory concerns vary by state and sector

AI adoption trends and statistics

Country comparison at a glance

Australia

Recent surveys indicate that approximately 40% of Australian businesses have started using AI in some capacity, with larger enterprises leading adoption (Australian Government Department of Industry, Science and Resources, 2024). Sales intelligence tools have become a focal point for many organisations, helping them improve lead generation, personalise outreach, and gain valuable insights into customer behaviour.

New Zealand

In New Zealand, 34% of medium-to-large businesses report using or trialling AI solutions (Stats NZ, 2023). Kiwi organisations are increasingly adopting AI tools that are simple to implement and fast to generate ROI – particularly in sales, customer engagement, and productivity workflows.

AI-powered sales intelligence in Australia and New Zealand

Sales teams across ANZ aren’t just dipping their toes into AI – they’re diving in headfirst, especially when it comes to sales intelligence. These tools are changing the game. No more guessing who to contact, when to reach out, or what to say. AI-driven platforms are helping teams zero in on high-value leads, tailor their messaging, and cut through the noise – fast.

In Australia, companies using sales intelligence report up to 50% boosts in productivity (McKinsey & Company, 2023). We’re seeing wide uptake in industries like SaaS, legal, and finance, where every moment counts and smart targeting matters.

New Zealand’s tech forward sales teams are using browser-based tools like Firmable to surface buyer signals, enrich contact data, and run sharper, more relevant campaigns – without needing a massive sales ops function.

Using AI isn’t experimental anymore. Sales intelligence is becoming foundational to how modern B2B teams run their outbound playbooks.

Want to see how AI agents are putting this into action?

Read our blog on how they’re transforming B2B sales in ANZ – from surfacing in-market leads to automating the admin no one wants to do.

AI in customer support and automation

AI chatbots and virtual assistants are becoming mainstream, especially in support roles:

- In Australia, around 60% of businesses using AI-powered customer service report improved efficiency and cost savings (CSIRO, 2024).

- In New Zealand, tools like chatbots, auto-responders and predictive workflows are being implemented across telcos, banking, and healthcare to reduce customer churn and handle high-volume requests.

Sales intelligence plays a key role here feeding the context and data that power smarter, faster responses.

Barriers to AI adoption in ANZ

While AI adoption is growing, several challenges remain:

- High implementation costs – Especially for small and mid-sized businesses.

- Data quality and bias – Poor or limited datasets hinder AI effectiveness.

- Regulatory concerns – Compliance and ethics frameworks are still evolving.

- Skills gaps – Many teams lack the in-house AI expertise to scale use cases.

Government support programs in both countries aim to close these gaps, but businesses must still choose tools that balance power with ease of use.

The role of sales intelligence in industry-specific transformation

Financial services: Banks and FinTech’s use AI for fraud detection, credit scoring, and customer analytics. Sales intelligence helps pinpoint high-value prospects and automate outreach workflows across account tiers.

Healthcare: Healthcare providers are improving diagnostics and admin tasks with AI. Sales intelligence helps with lead nurturing, partner outreach, especially for private clinics and health tech vendors.

Retail and e-commerce: Retailers use AI to personalise offers, forecast demand, and streamline logistics. Sales intelligence tools support supplier prospecting, stockist acquisition, and data-driven territory expansion.

Construction and manufacturing: AI is being adopted for predictive maintenance and operational planning. Sales intelligence helps firms surface project leads, track procurement trends, and close B2B opportunities faster.

What’s next for AI adoption?

As AI continues to mature, expect faster growth:

- Wider adoption across mid-market and regional sectors

- Seamless integration into CRMs and sales workflows

- Greater transparency via explainable AI (XAI)

- A shift from experimentation to scale

Companies that invest early in AI-powered sales intelligence will have a clear head start in capturing demand and improving execution.

The impact of AI regulation in Australia and New Zealand

Both governments are evolving their frameworks:

- Australia is progressing its focusing on fairness, transparency and accountability.

- New Zealand is embedding principles of trust and equity into its Digital Strategy for Aotearoa.

Businesses need to stay informed and ensure that any AI systems used – particularly in sales adhere to privacy laws, offer explainability, and avoid discriminatory outcomes.

Final thoughts

AI adoption is no longer optional for businesses looking to stay competitive. As AI transitions from early adoption to mainstream usage, companies that proactively invest in sales intelligence and other AI-driven solutions will be better positioned for growth.

At Firmable, we’re committed to leveraging AI to enhance data accuracy, streamline prospecting, and empower smarter decision-making. With AI agents in the Firmable platform, we automate the boring stuff, allowing you to focus on what truly matters: building relationships and closing deals.

- 1. Understanding the AI technology adoption curve

- 2. Australia, New Zealand and the USA: How AI adoption compares

- 3. AI adoption trends and statistics

- 4. AI powered sales intelligence in Australia and New Zealand

- 5. Barriers to AI adoption in ANZ

- 6. The role of sales intelligence in industry-specific transformation

- 7. What’s next for AI adoption?

- 8. The impact of AI regulation in Australia and New Zealand

- 8. Final thoughts

FAQs on AI adoptions trends in ANZ

Sales intelligence is the process of gathering and analysing data to help sales teams identify prospects, personalise outreach, and close deals faster. AI-powered platforms automate this by surfacing real-time buyer signals and streamlining prospecting.

Around 40% of Australian and 34% of New Zealand businesses have adopted AI, with strong momentum in sales, customer support, and marketing. Sales intelligence is one of the fastest-growing use cases.

AI helps B2B sales teams improve lead targeting, automate manual tasks, and personalise engagement. It increases productivity, improves CRM accuracy, and supports more predictable pipeline generation.

Common challenges include high implementation costs, lack of in-house expertise, data quality issues, and evolving regulatory requirements. Government support and AI-as-a-service platforms are helping bridge the gap.

Financial services use it for fraud detection and client targeting. Healthcare providers apply it to patient outreach and referrals. Retail and e-commerce leverage it for supplier prospecting and customer engagement at scale.

Additional resources

Don't forget to share this post!

You may also like

The best AI sales stacks in APAC start with clean data, then scale with automation. This guide covers eight top AI sales tools for B2B teams in 2026, and how to combine them to improve targeting, timing, outreach, and conversion quality across the region.

Learn when and how to reach out to prospects using verified buying signals. Discover proactive sales tips and real-time outreach timing with Firmable.

AI voicebots are shaking up outbound sales in the US – but will ANZ buyers trust a synthetic voice? We break down what works (and what backfires), explore key compliance rules, and share why Firmable backs real reps, supported by smart signals.

Grow your business faster with Firmable data

With the largest Australian and New Zealand B2B database and the only local support team, it’s easy to get started with Firmable.